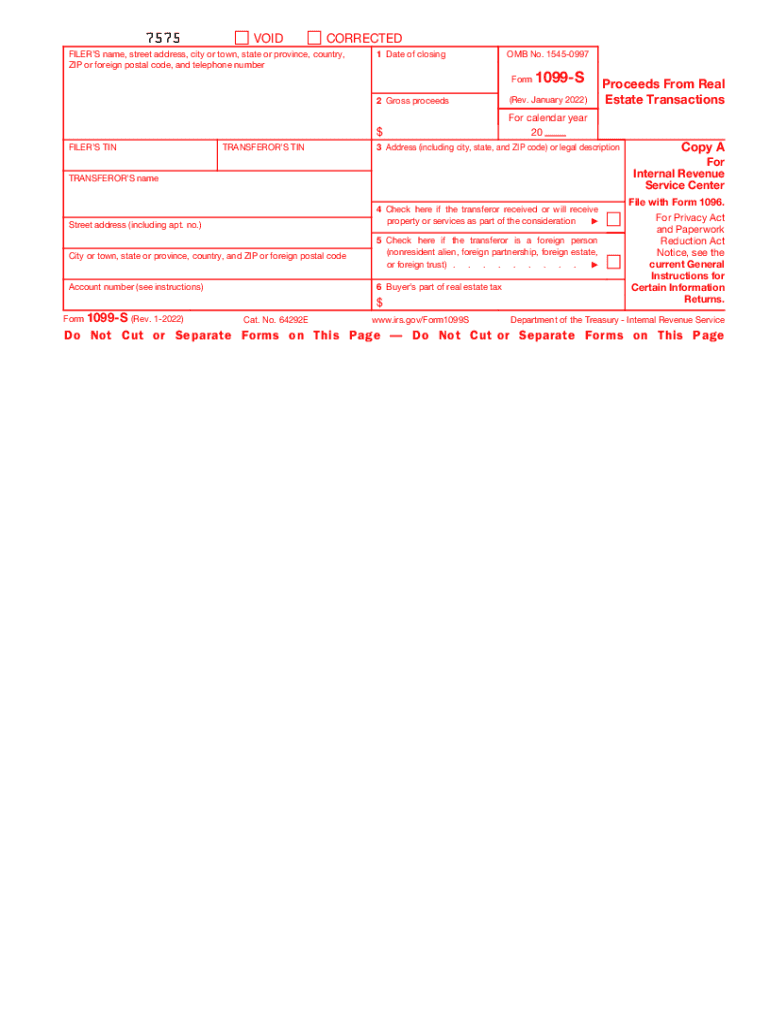

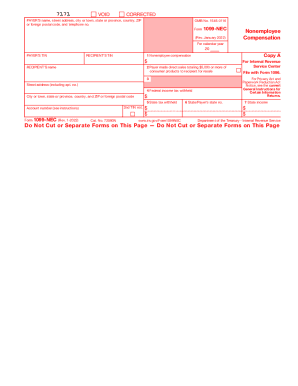

Who needs Form 1099-S?

Form 1099-S is officially called Proceeds from Real Estate Transactions. It is filled out by the person responsible for closing real estate transactions. Generally, the form is issued by the title or lending company. If no person has sealed the deal, 1099-S is filled out by the person who gets the most significant interest in the property. A seller to whom this document is issued must report real estate transactions on their income tax return.

What is Form 1099-S?

The sale of the house or other real estate is always connected with tax implications. The IRS Form 1099-S is used to make sure that the seller of the real estate reports the total amount of benefits they get from property sale or transfer.

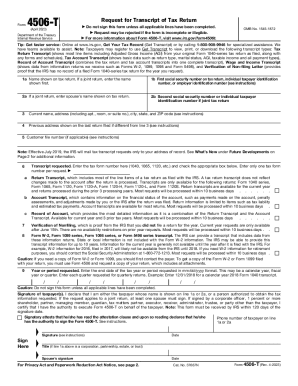

Do other forms accompany 1099-S?

When reporting the home sale, you may need to fill out Form 1040 Schedule D and Form 8949.

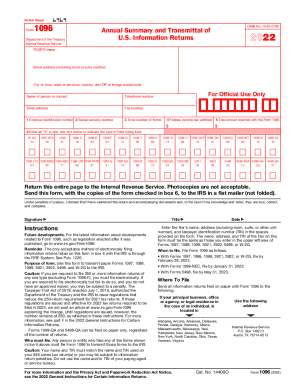

When is the IRS Form 1099-S due?

The report must be sent to the recipient by February 15 and e-filed with the IRS by March 31 each year.

How do I fill out Form 1099-S?

The document consists of six pages, including brief Form 1099 S instructions. Do not complete Copy A. It is used for information purposes only.

You may easily fill out Copies B and C online in a fillable PDF format available at the top of this web page. Simply open the template in your browser and enter the required information. This information includes the filer’s name, address, transferor’s name, and address, as well as the date of closing, gross proceeds, etc.

Where do I report 1099 S?

You should submit your completed 1099-S with the IRS.